Among US homeowners, almost 40% say they’ve given serious thought about going solar. What holds most back is the high upfront costs of a PV installation. But wait! — you don’t have to pay for it on your own. State incentives can bring down your expenses by up to half. In this article, we'll dive into solar panel government programs.

1. Solar Investment Tax Credit: Get 30% off PV system cost

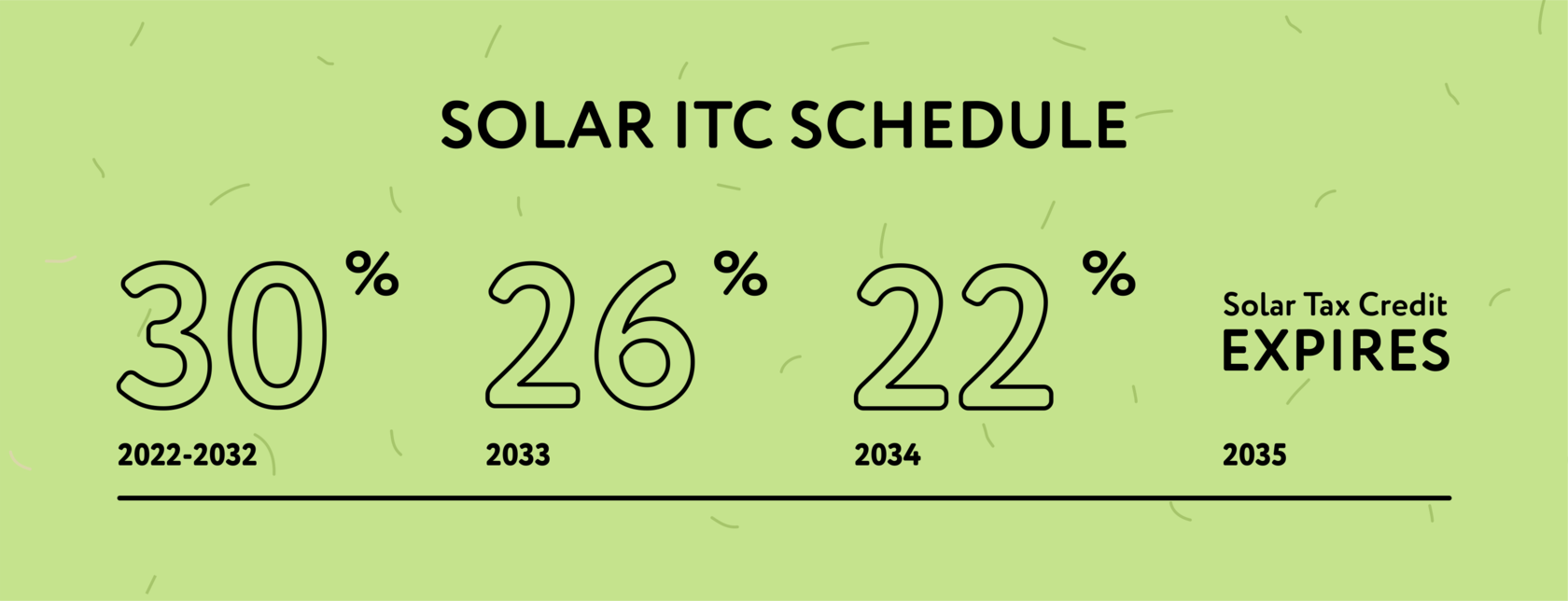

The ITC, or the Solar Investment Tax Credit, allows businesses and individuals to claim a tax credit equal to 30% of the cost of their solar panel system and its installation. The tax credit applies to both residential and commercial properties and is available to those who install solar panels before December 31, 2034.

Here is how it works: If a household installs a solar panel system worth $20,000, they can subtract $6,000 from their income taxes, reducing the net cost of a PV system to $14,000. You can carry over the remaining credit to subsequent years. This way you're virtually guaranteed to get back the 30% that this solar incentive promises.

The credit will decrease after 2032 and eventually phase out entirely in 2035. Act quickly to take advantage of the full tax credit! Claiming the ITC is easy and takes three major steps:

• Determine if your system qualifies for the ITC

• Complete IRS Form 5695

• Add your residential energy credit information to Schedule 3 (Form 1040)

2. State solar tax incentives: Bring taxes down further

Some US states offer a form of their own solar tax credit. The percentage of the credit and the total amount available vary depending on the state. For example, Arizona offers a tax credit of up to $1,000, while in Massachusetts, the tax credit is up to $1,000 or 15% of the total cost of the system, whichever is less.

The process of claiming state tax credits is similar to claiming the ITC:

• Obtain documentation like receipts and invoices for the costs associated with your solar system.

• Fill out the necessary state tax forms. These may vary by state, so be sure to research the details.

• Submit the forms to the responsible entity in your state and wait for approval.

3. Property tax exemptions: Freeze your property tax

4%

how much solar panels increase your property value on average

Another way in which states incentivize solar is by offering property tax exemptions. This means your property becomes more expensive after installing solar panels, but your taxes stay exactly the same. In New Jersey, for example, solar installations are exempt from property tax for 15 years.

You don’t need to explicitly claim tax exemptions. In most states, the process is automatic: the local body responsible for property tax assessment will be aware of the solar system installation and adjust the assessment accordingly.

4. Solar sales tax exemptions: Buy equipment cheaper

Some states offer sales tax exemptions on solar installations. This means solar equipment is cheaper in those states, saving you money before you even buy anything. For example, in New York, solar installations are exempt from a 4% sales tax. This means you save $800 when purchasing a $20,000 PV system in the Big Apple. Solar sales tax exemption is applied automatically and you don’t have to do anything to get it.

5. Solar rebates: Let utility help

Many power companies offer rebates to customers who install solar panels on their homes or businesses. Some utilities have specific programs for low-income customers or those who live in areas with high levels of air pollution. The rebates can come in the form of cash incentives, reduced rates for electricity, or other benefits.

For example, in California, Pacific Gas and Electric (PG&E) offers a rebate program for residential and commercial customers who install solar panels. The rebate amount varies depending on the size of the system but can be up to $1,000 per kW of installed solar panels. Similarly, Xcel Energy in Colorado offers a Solar*Rewards program with upfront rebates of $1 per watt of installed solar up to 7 kW for customers who qu

Utilities may ask for all the RECs (see below) that your system will generate in exchange for rebates. Take time to calculate what’s more profitable for you: RECs or rebates.

6. Solar loans: Switch now, pay later

Low-rate loan programs help finance the purchase and installation of solar energy systems. Aside from lower interest rates, these loans are often available to borrowers with lower credit scores.

10.82%

average personal loan interest rate in 2023

Some programs are funded by state or federal grants, while others are backed by private banks or credit unions. Loan terms may range from 5 to 20 years, with interest rates typically in the 3% to 8% range, depending on the borrower's credit score and other factors. The funds can be used to finance the cost of purchasing and installing a solar energy system, including labor. In some cases, you can also finance energy efficiency upgrades, such as insulation.

To qualify for a low-rate loan program for solar energy, borrowers will typically need to meet certain eligibility requirements, such as owning their home or having a certain credit score. Borrowers may also need to provide documentation of their income, expenses, and other financial information.

While solar loans help bring down the upfront costs, they reduce the savings from your solar panel system. Read more in our free guide on how to save money with solar energy.

7. RECs: Earn the proof of going green

Renewable Energy Credits (RECs) are a way to incentivize the generation of clean energy. A REC represents the environmental and social benefits of one megawatt-hour (MWh) of renewable electricity generation. When a solar system produces one MWh of electricity, it generates one REC that can be sold to help finance the solar project.

RECs can be sold separately from the electricity they represent, providing an additional source of revenue for solar system owners. RECs can also be used by utilities to meet their renewable energy goals.

10 RECs

how many a 5 kW system generates annually in California

A homeowner in California who installs a 5 kW solar system can generate around 10 MWh of electricity annually. This equates to 10 RECs that can be sold to utilities or other companies, providing an additional source of income for the homeowner. The prices are volatile but have reached up to $200 in the past years.

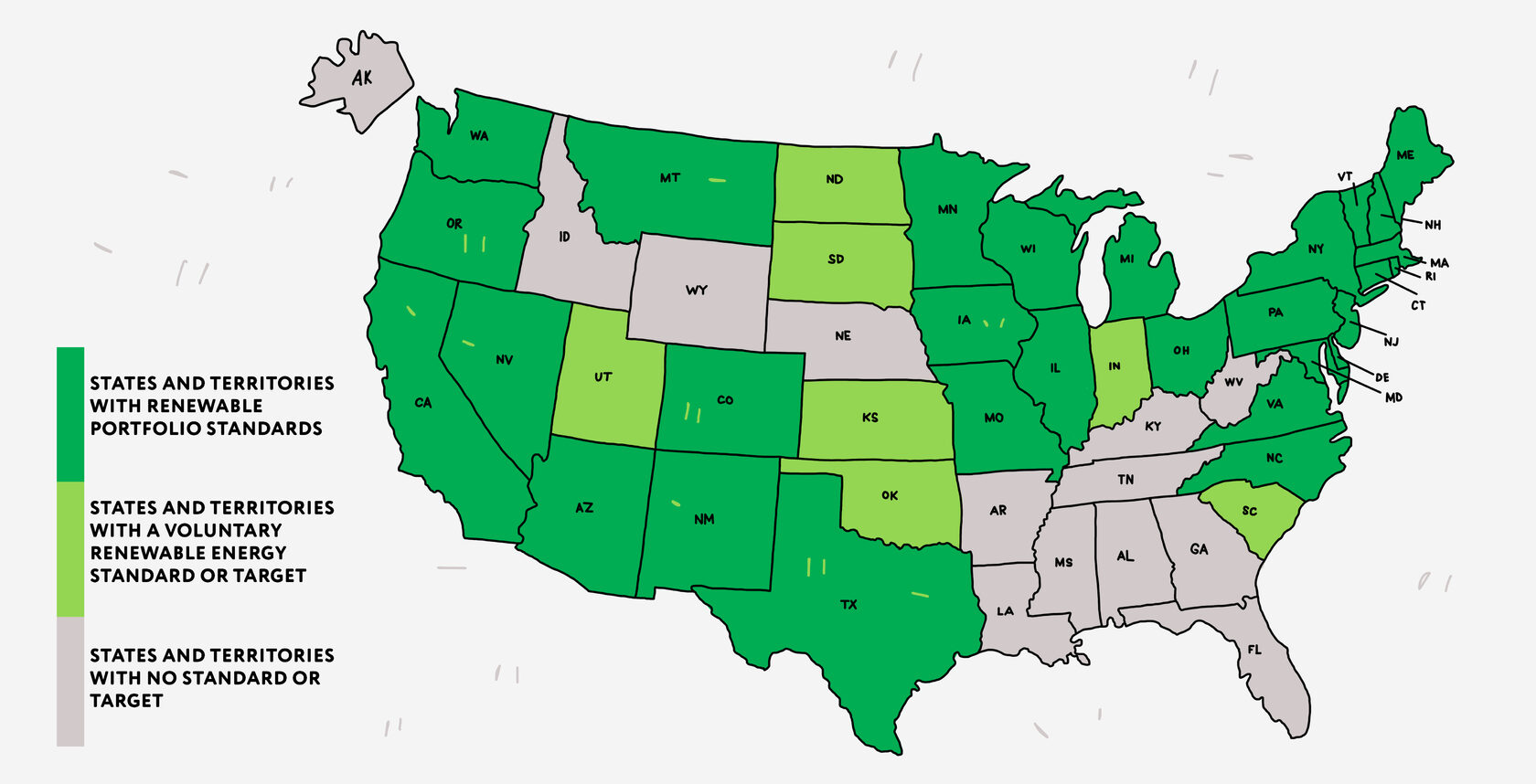

Such credit systems have been adopted by most states, but in a handful of locations the work is still in progress. If your state is green on the map below, here’s an outline of how you can collect and trade the RECs:

• Register your system with the Public Utilities Commission or another organization designated by the state’s authorities. The process usually includes filling out an application form and a physical examination of your system.

• Start generating energy with your solar array. RECs will be created automatically. You can monitor your certificates via the tracking platform used in your state.

• Sell RECs via the very same platform or contact a broker like SRECTrade or SolSystems for that. Keep in mind that the life of RECs is limited – your certificates will typically expire in 5 years.

In some states, homeowners can also receive RECs as part of their participation in net metering programs. For example, in Massachusetts, homeowners automatically receive one REC for every MWh of electricity they generate.

8. PBI: Generate to earn

Unlike simple rebates, RECs and net metering, performance-based incentives are paid based on the amount of electricity your system actually produces. This incentivizes homeowners to design efficient solar panel systems and keep downtime to a minimum.

Xcel Energy’s Solar*Rewards program in Minnesota is an example of a performance-based incentive, where solar owners can receive payments of up to $0.07 per kWh of production during the first ten years of system operation.

9. REAP: Ask to help you grow

REAP is a Rural Energy for America Program. You can get a grant or a guaranteed loan through it. The grant acts like a 25% discount off your new solar installation, up to $500,000. The loan can cover up to 75% of the costs of a solar project with the maximum loan amount being $25 million. Grant applicants must provide at least 75% of the project cost. Those who apply for a loan, or a loan and grant combination, must provide at least 25% of the project cost. Apply for the REAP program at the US Department of Agriculture website.

10. Solar easements: Secure your place under the sun

A solar easement is a legal agreement between you and your neighbors that guarantees unobstructed access to sunlight for your solar system. Essentially, it protects your panels from shadows that may come from your neighbors’ property. If they agree, they’ll be wary of erecting constructions that may cause shading and trim trees that pose a threat to your system.

The agreement defines the easement area, the duration of the easement, and the terms and conditions under it may be exercised. Some states even offer tax incentives or other financial benefits to property owners who agree to grant solar easements to their neighbors. To check if your state has this policy, visit our Solar Power Rankings. For every state in the list, we have an article describing all available solar panel government programs!

What solar incentives your state has to offer?

Check out the programs in your area that will lower your upfront costs of going solar and increase savings!

State Solar incentives

U.S. Climate Bill: 30% Solar Tax Credit comes back

U.S. Climate Bill: 30% Solar Tax Credit comes back Take my energy: What is net metering and how it works

Take my energy: What is net metering and how it works Portfolio Energy Credits: How to make your PV system print money

Portfolio Energy Credits: How to make your PV system print money What the sun yields: A story of a Texas couple who got solar panels for a farm

What the sun yields: A story of a Texas couple who got solar panels for a farm Shading analysis: How to pick a sunny spot for solar panels

Shading analysis: How to pick a sunny spot for solar panels