If you’re sitting in Miami or somewhere close and you don’t know whether or not you need a solar system, our advice — go for it! Solar panels pay off in spades in Florida. If high upfront costs are what scares you, here is an article about Florida solar incentives and programs that make the switch so much easier.

Key takeaways

- Florida is one of the best states to install a solar panel system. And multiple commercial and residential clean energy credits and rebates make it even better. Explore what your renewable energy system is eligible for.

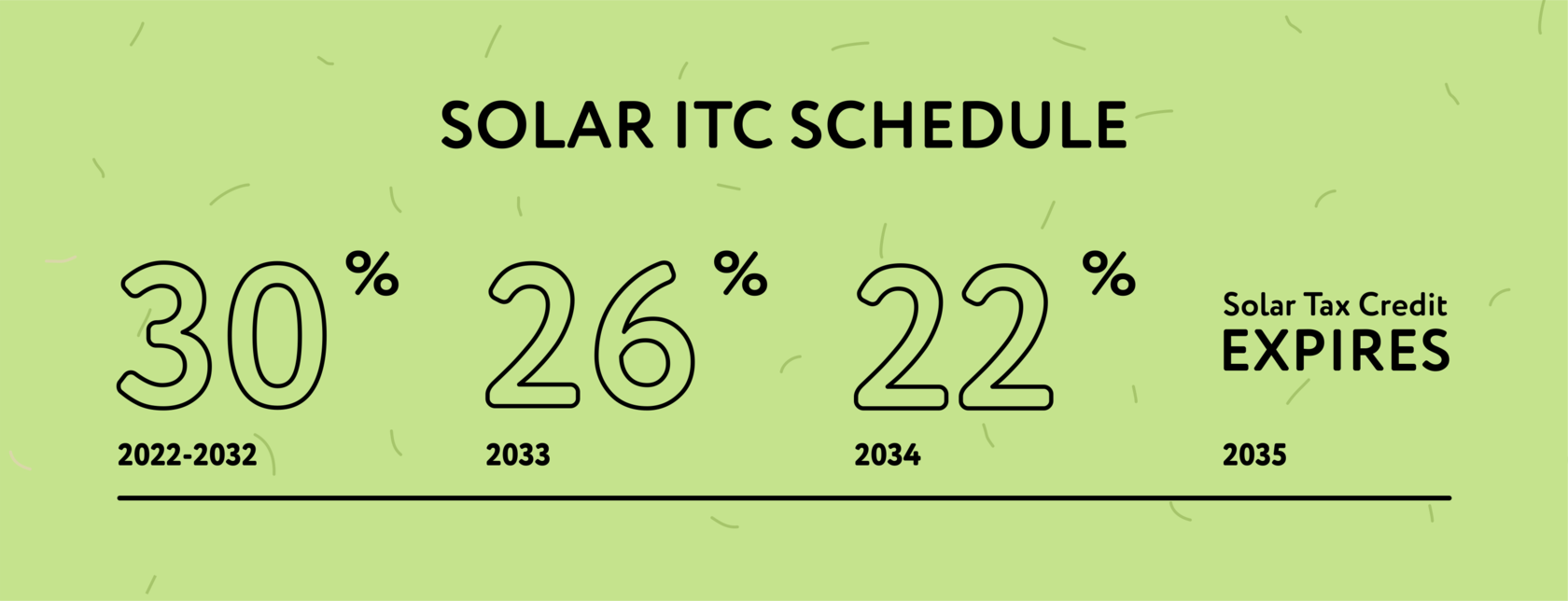

- Federal Solar Tax Credit offers a 30% tax credit on the total quote of solar system installation, including cost of energy storage systems.

- State Sales Tax Exemption provides exemption from 6% sales and use tax on solar equipment (panels, inverters, etc.). Equipment must be certified by the Florida Solar Energy Center.

- Property Tax Exemption gives a 100% property tax exemption for home solar systems. 80% tax abatement for non-residential PV installations. Exemption expires on December 31, 2037.

- Property-Assessed Clean Energy (PACE) offers financing for energy improvements, including solar. Low-interest loans.

- With the benefit from net metering, utility customers are usually compensated at a full retail rate for excess solar energy from their service companies. Credits are carried forward for up to 12 months. Utility pays for remaining credits at an avoided cost rate.

- Some Florida utilities may offer rebates for solar installations. Florida utilities mostly provide rebates for solar water heating technology.

- Solar Easements in the form of agreements between neighbors ensure solar access. Homeowner associations cannot prohibit solar system installations but can impose reasonable restrictions.

Going solar in Florida: Sun, storms, and expensive electricity

5.6

average number of peak sun hours in Florida

At first glance, Florida might not appear as a nice place for setting up a solar installation. The state gets only about 100 clear days a year on average. Miami is in the Top-10 American cities with the most days with partial cloud cover.

The benefits of going solar in Florida shine through when you look closer. The state gets 5.6 peak sun hours a day on average throughout the year. In summer solar panels work at full capacity for more than 6 hours a day. A 7 kilowatt solar system is going to produce over 30 kWh of AC for your house in June. That’s more than enough to cover the average daily needs of a medium-sized house.

Florida is affected by a tropical storm or hurricane every 3-5 years

Florida is notorious for hurricanes. Solar panels don’t see them as a threat though. Most panels are made to endure at least 140 mph winds. Add batteries and a hybrid inverter to your system, and your house will retain power even when power lines are down.

What’s most important, electricity is expensive in Florida. Florida residents spend around $230 per month on electricity. That’s 40% higher than the US average electric bill of $150. Having a solar system that fully covers your consumption would bring you around $2,500 per year. This PV installation would pay for itself in 4-6 years. The ROI is higher if you make use of Florida solar energy programs.

There is a reason why A1SolarStore headquarters are located in Miami. There is lots of sunlight, electric rates are high, and you want an energy backup when a storm comes to visit. All this makes PV systems attractive for Floridians.

Solar laws, incentives and rebates in Florida you need to know

The smart way of going solar is making use of incentives and programs that the state and utilities have to offer. Let’s go over the most important ones in detail.

Solar Tax Credit lets you deduct 30% of PV system cost from taxes

Solar Investment Tax Credit (ITC) is the king of American solar incentives. You can deduct 30% of your PV system’s cost from your income taxes. The cost includes not only solar panels but other equipment plus and shipping and installation expenses. For example, if your system costs $15,000, you can get $5,000 back through a tax deduction. Unused credit carries over to the next year.

Solar panels are 6% cheaper with Florida sales tax exemption

Solar equipment is free from 6% sales and use tax for residents. Solar panels, inverters, charge controllers, batteries and addons have to play an integral role in your PV system though. This incentive was made permanent in 2005.

The equipment must be certified by Florida Solar Energy Center. Complete this form to qualify for the exemption or email us at solar@a1solarstore.com upon checking out.

Property tax stays the same with solar panels tax exemption

4%

that’s how much solar panels increase your home value on average

Solar panels increase the value of your home by 4% on average. This would mean higher property taxes in other states but not in Florida. Florida provides a 100% property tax exemption for home solar systems and an 80% tax abatement for non-residential PV installations. This incentive is to expire on December 31, 2037

Florida offers low-interest loans for solar with PACE Program

Some local governments in Florida offer Property-Assessed Clean Energy (PACE) financing programs. They let property owners borrow money to pay for energy improvements, such as a solar system. You repay the loan with an interest rate that is lower than average — for example, 7-7.5%.

10.82%

average personal loan interest rate in 2023

Contact your local government to learn if PACE is available to you. You can apply through the Florida PACE Funding Agency website.

Florida buys solar energy at full retail rate

Florida utility customers are usually compensated at a full retail rate for their excess solar energy. Credits that you earn for excess generation are carried forward at a retail rate to the next bill for up to 12 months. At the end of this period, the utility pays the customer for any remaining NEG at the utility's avoided cost rate.

Net metering — a policy designed to compensate homeowners for excess solar energy that they generated and sent into the grid

The net metering policy narrowly escaped its demise in 2022. Both houses of the Florida legislature passed a bill that would deny net metering credits for utility customers with solar systems launched in 2024 and later. Governor DeSantis vetoed the bill but this case might be a sign of things to come. If you want to go solar, act fast and secure a good deal in 2023.

Ask your utility about solar rebates

American utilities can offer rebates to customers that switch to solar. This makes the purchase of a system easier. Florida utilities mostly provide rebates for those who use solar water heating technology. Thermal panels are different from photovoltaic solar panels and rebates for one type don’t apply to the other. You can learn more about two types in our article about solar panels for pools.

Still, it doesn’t hurt to ask your utility if they offer any kind of rebates for photovoltaic solar panels. If they do, you might save a couple of hundred dollars on the purchase.

Solar easements help to settle disputes with neighbors

Florida law states that homeowner associations can’t prohibit the installation of a solar system. If your HOA imposes any restrictions, they must be reasonable, not arbitrary, and applied for all association members. Those restrictions must not affect the performance or increase the cost of a solar system.

The law allows for the creation of easements which are agreements between neighbors in written form about keeping a solar system exposed to sunlight. For example, an easement means that your neighbor has to cut trees on his land if they grow tall enough to cast a shadow on your panels. Solar easements are voluntary and tied to the property. If your neighbor sells his house, the original easement agreement will retain force.

1. Myth: Solar panels only work in very sunny places

Reality: Yes, they work best when the sun is bright. But they don't need constant, super-strong sunlight. They turn daylight into electricity, even on cloudy days. Plus, they can even work better when it's a bit cold. So, even if you don't live in a sunny place, solar panels can still be useful.

2. Myth: Solar panels cost too much money

Reality: It's true that they cost money to install. But the price has gone down, and there are ways to get help paying for them. You might get money back from the government, or pay less in taxes. Also, they can save you a lot on your electric bill over time. Solar panels last a long time, so they can pay for themselves.

3. Myth: Solar panels need lots of fixing

Reality: They don't need much fixing at all. They don't have moving parts, so they rarely break down. You might need to clean them sometimes, but rain often does that for you. And they're made to handle bad weather.

4. Myth: Solar panels will hurt my roof

Reality: If they're put on correctly, they won't hurt your roof. Good installers make sure they're secure and won't leak. They can even help protect your roof.

5. Myth: Solar panels don't make enough electricity

Reality: They're much better at making electricity now. Scientists are always making them better. They can turn a good amount of sunlight into electricity.

6. Myth: I won't need the power company anymore

Reality: Unless you have a lot of batteries, you'll probably still need the power company. You'll use their electricity when your panels aren't making enough, like at night. And sometimes, you can sell extra power back to them.

7. Myth: Putting in solar panels takes forever

Reality: It's not that hard, especially with professionals. It usually only takes a few days.

8. Myth: Solar panels look bad

Reality: They look better now than they used to. Many look sleek and blend in with roofs. You can also put them on the ground.

9. Myth: Renters can't use solar power

Reality: Renters can use community solar programs. These let you use part of a big solar farm and save on your electric bill.

10. Myth: It's hard to sell a house with solar panels

Reality: Houses with solar panels often sell for more money and faster. They're a good selling point.

Check out solar panels near you!

Looking to build a home solar system? Check out solar panels that we have for sale in Florida

Take my energy: What is net metering and how it works

Take my energy: What is net metering and how it works